Project: AI-Enabled Assistant – Insurance Claim Management System

Platforms: Web

Role: Senior UX Designer

Claims Agent requested to design an AI-enabled assistant. aimed at transforming and streamlining the insurance claims process. The feature facilitates intelligent decision-making and communication, providing adjusters with tools for liability recommendations, cost estimations, and direct claimant correspondence, all designed to enhance the efficiency and accuracy of claims management.

CASE STUDY

Project Overview

Client: Claims Agent

Project: AI-Enabled Assistant – Insurance Claim Management System

Platforms: Web

Role: Senior UX Designer

Claims Agent requested to design an AI-enabled assistant. aimed at transforming and streamlining the insurance claims process. The feature facilitates intelligent decision-making and communication, providing adjusters with tools for liability recommendations, cost estimations, and direct claimant correspondence, all designed to enhance the efficiency and accuracy of claims management.

Project Team

Design Team: Senior UX Designer (myself)

Client Team: Stakeholder, Product Owner, Engineering Lead, Engineering Team

Time Frame:: 3 Months

Context

The primary users of the system are insurance adjusters, who engage daily with it to oversee and manage claims. Their work involves performing in-depth reviews of claim submissions to determine liability and costs, which is critical for accurate and efficient claim processing. Additionally, adjusters are heavily involved in continuous communication with all parties related to a claim, providing customer support and coordinating necessary actions to resolve each case effectively. This ongoing interaction is vital for maintaining clear channels of communication and ensuring all stakeholders are informed throughout the claims process.

Problem

The insurance industry must streamline operations and enhance customer satisfaction by improving claims management efficiency and clarity. Insurance adjusters play a crucial role, balancing accurate assessments with swift case resolution. Understanding their workflows, challenges, and requirements is essential for an effective claims management system, enabling informed decisions on claim validity and settlement amounts. However, miscommunications and inconsistent decisions can cause delays and increase operational costs, highlighting the need for improved claims processing to meet customer expectations and boost efficiency.

Objective

-

Enhance the efficiency of claims processing to handle claims swiftly and accurately.

-

Improve the accuracy of liability recommendations and cost estimations for fair and timely resolutions.

-

Streamline communication between insurance adjusters and claimants to ensure clear and consistent information exchange.

-

Reduce operational costs while maintaining high levels of customer satisfaction.

STAGE 1: EMPATHIZE

Tasks

-

Review Requirements: Analyzed project requirements to ensure alignment with business goals and user expectations.

- Industry Education: Gained insights into the insurance industry by studying claims processing techniques and the structure of insurance operations.

-

Conduct Interviews: Engaged with stakeholders and claims adjusters through interviews to gather insights and ensure the system meets the specific needs of its primary users

Stakeholder Requirements

-

Operational Efficiency and Customer Satisfaction: Create a system that boosts efficiency, streamlines communication, and enhances satisfaction while reducing operational costs.

-

Enhanced System Capabilities: Focus on developing a user-friendly interface that supports adjusters of all tech levels, integrates seamlessly with existing systems, and utilizes AI to increase accuracy and reduce claims processing time.

-

Compliance and Security: Prioritize meeting industry regulations and ensuring the protection of sensitive data within the system’s framework.

Industry Education

-

Claims Processing Techniques: Learned about various methods and best practices for efficiently handling and processing insurance claims, including steps for evaluating and verifying claim information.

-

Regulatory Compliance: Gained an understanding of the regulatory framework governing the insurance industry, ensuring that the system meets all legal requirements and standards.

-

Technological Integration: Explored how advanced technologies, such as AI and automation, are being integrated into insurance operations to streamline workflows and improve accuracy.

-

Customer Satisfaction Metrics: Studied the key metrics used to measure customer satisfaction in the insurance sector, emphasizing the importance of timely communication and transparent claim resolutions.

Interviews

Completed a total of 8 interviews, 6 Journalists, 2 Stakeholders, utilizing a mix of in-person, video, and phone call formats.

Key Findings

- Operational Efficiency: Stakeholders highlighted the need to streamline operations to reduce costs and improve productivity across the claims management process.

- Regulatory Compliance: Emphasized the importance of ensuring that all processes and systems comply with industry regulations and legal standards.

- Customer Satisfaction: Stakeholders stressed the importance of enhancing customer satisfaction through timely and transparent claim resolutions.

- Data-Driven Insights: There is a strong interest in leveraging data analytics to gain insights into claim trends and improve strategic decision-making.

- Workflow Streamlining: Adjusters expressed a need for a system that simplifies their workflow, reducing manual data entry and repetitive tasks.

- Decision Support Tools: There is a demand for AI tools that provide accurate liability recommendations and cost estimations, assisting adjusters in making informed decisions.

- Communication Tools: Adjusters need reliable tools for clear and consistent communication with claimants and other stakeholders to keep everyone informed throughout the process.

- Usability and Training: Adjusters prefer a user-friendly interface that is easy to learn and use, minimizing the time required for training and allowing them to focus on their core tasks.

STAGE 1: EMPATHIZE – Key Findings Overview

In the first stage, we focused on understanding the requirements, industry standards, and insights from interviews with stakeholders and insurance adjusters to build a user-centered claims management system. We analyzed project requirements to align with business goals and user expectations, emphasizing streamlined workflows and efficient operations. Through industry education, we gained insights into claims processing techniques, regulatory compliance, technological integration, and customer satisfaction metrics to ensure the system meets industry standards. Additionally, we engaged with stakeholders and adjusters to identify key needs such as operational efficiency, accurate decision-making tools, clear communication channels, and a user-friendly interface. These findings provided a solid foundation for designing a system that enhances efficiency, accuracy, and user satisfaction in the claims management process.

STAGE 2: CONCEPTUALIZE

Tasks

- Develop User Personas

- Define AI-Enabled Features

- Create Sketches

- Produce Wireframes

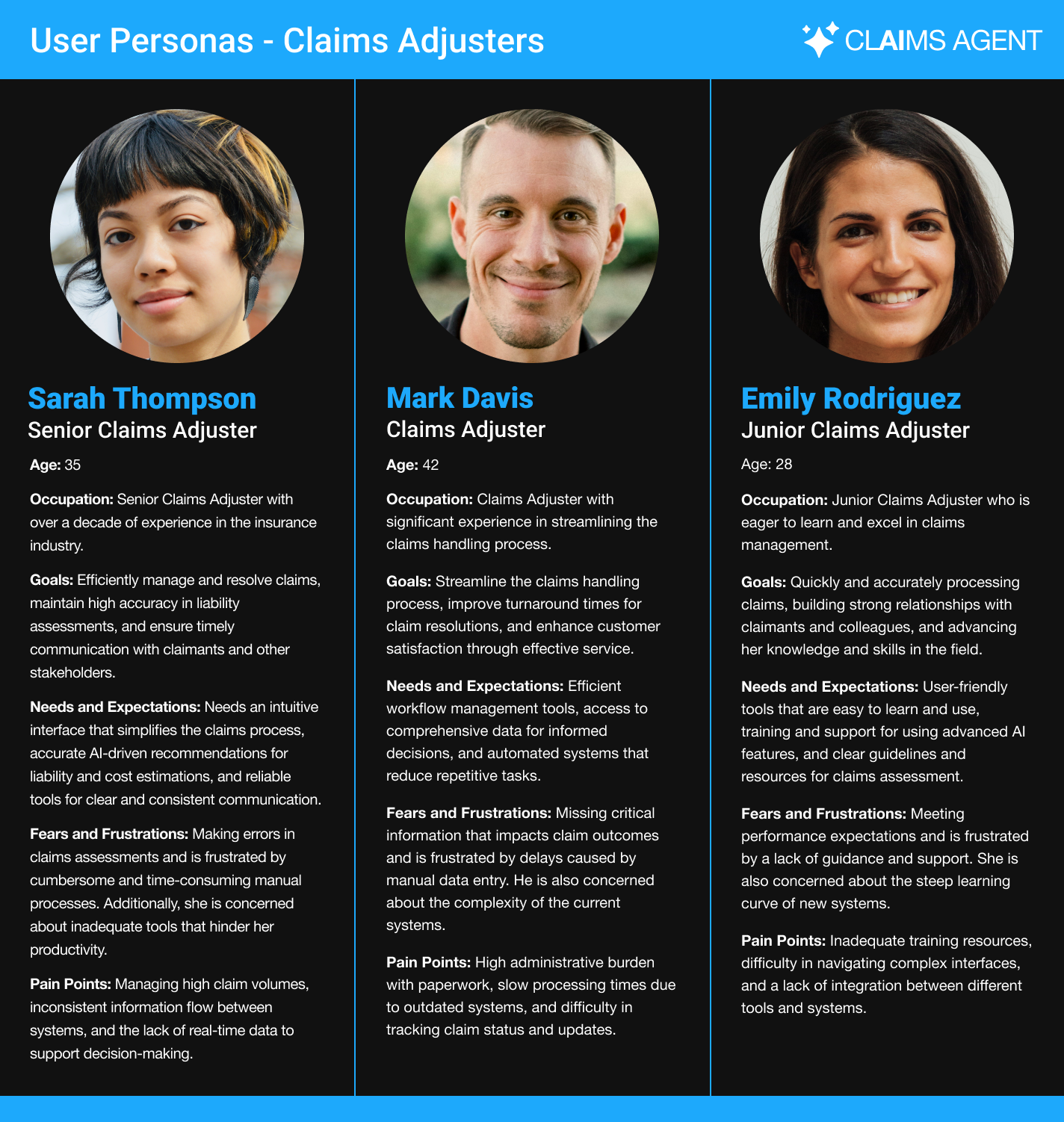

User Personas

We developed three user personas representing potential users of the Insurance Claim Management System, each tailored to reflect the distinct roles, needs, and challenges faced by insurance claims adjusters.

Key Findings

The key findings from the three user personas collectively highlight the need for an intuitive and efficient claims management system that addresses the diverse challenges faced by insurance adjusters. They require a system that enhances accuracy in liability assessments, streamlines workflows, reduces cognitive load, and facilitates clear communication. Additionally, there is a strong demand for reliable support and training resources, particularly for less experienced adjusters, to navigate complex interfaces and integrate new AI-driven tools effectively.

AI-Enabled Features

The AI system in the insurance claims processing framework is designed to optimize every facet of claim resolution, integrating advanced capabilities for accuracy, efficiency, and compliance.

-

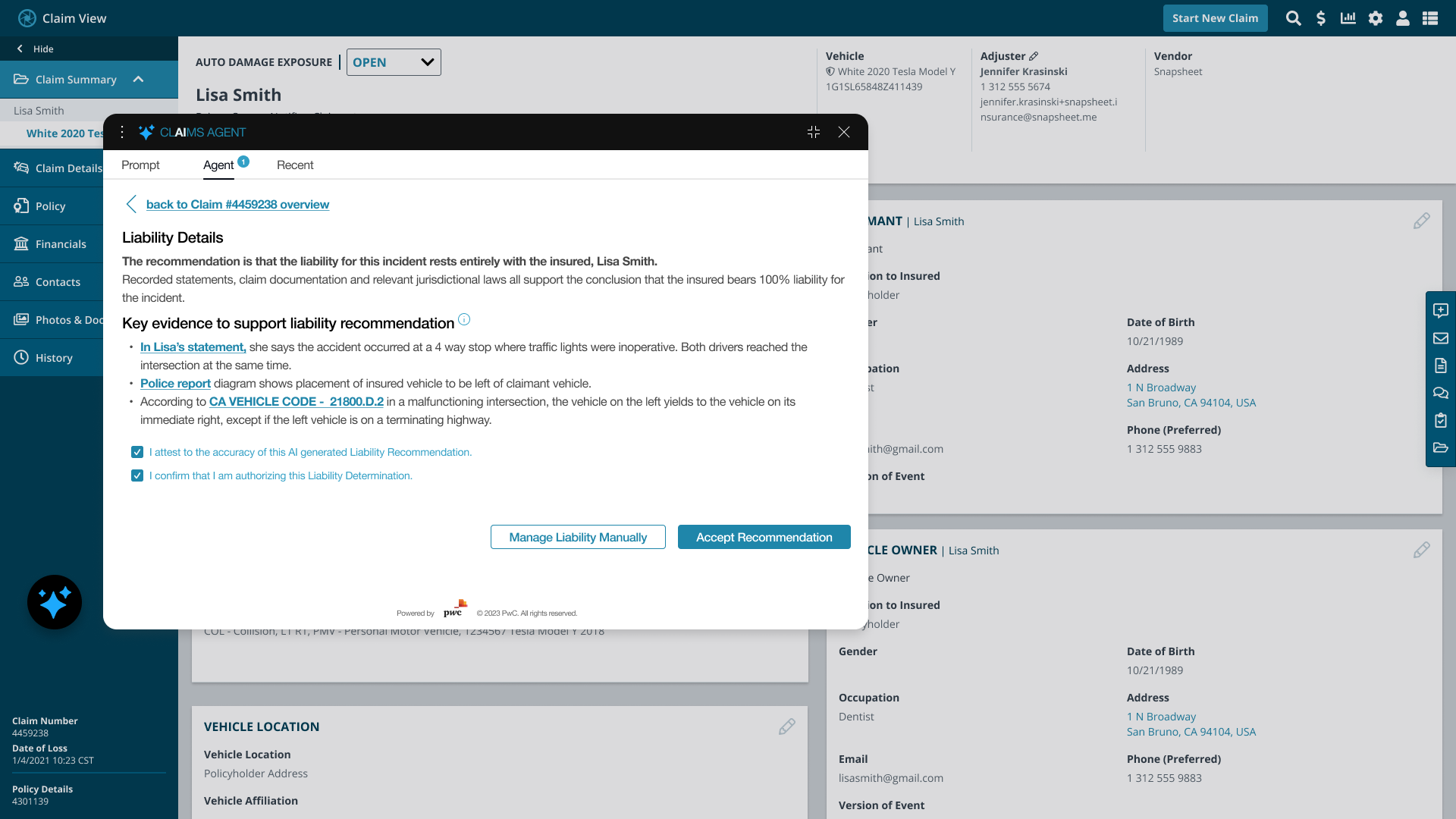

Analysis & Liability Recommendations: Conducts comprehensive analysis of key evidence like recorded statements, claim documentation and jurisdictional laws. Offering precise liability recommendations.

-

Contextual Analysis & Compliance: Analyzes document contexts and cross-references data to ensure legal compliance and identify potential fraud, establishing claim accuracy.

-

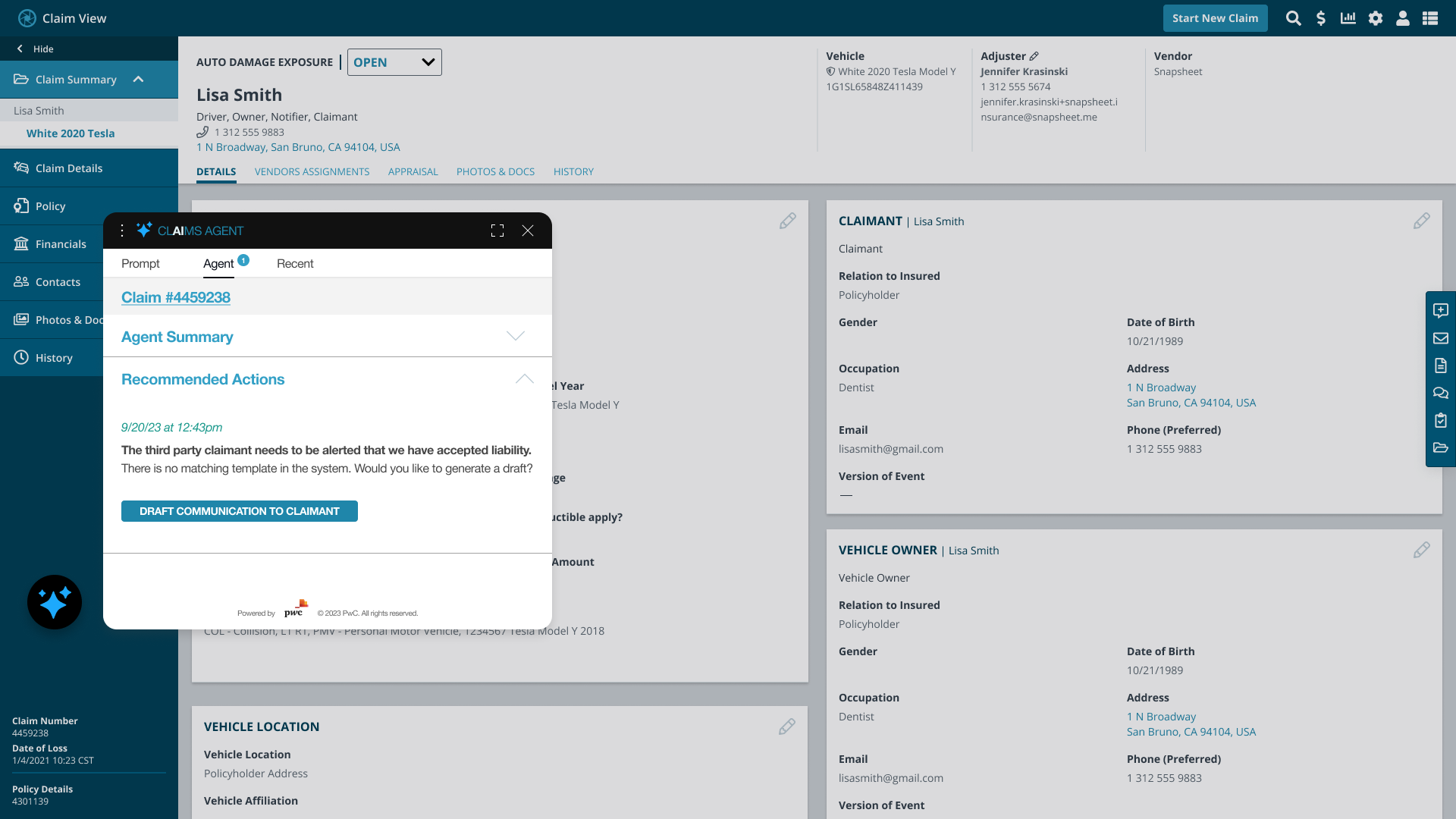

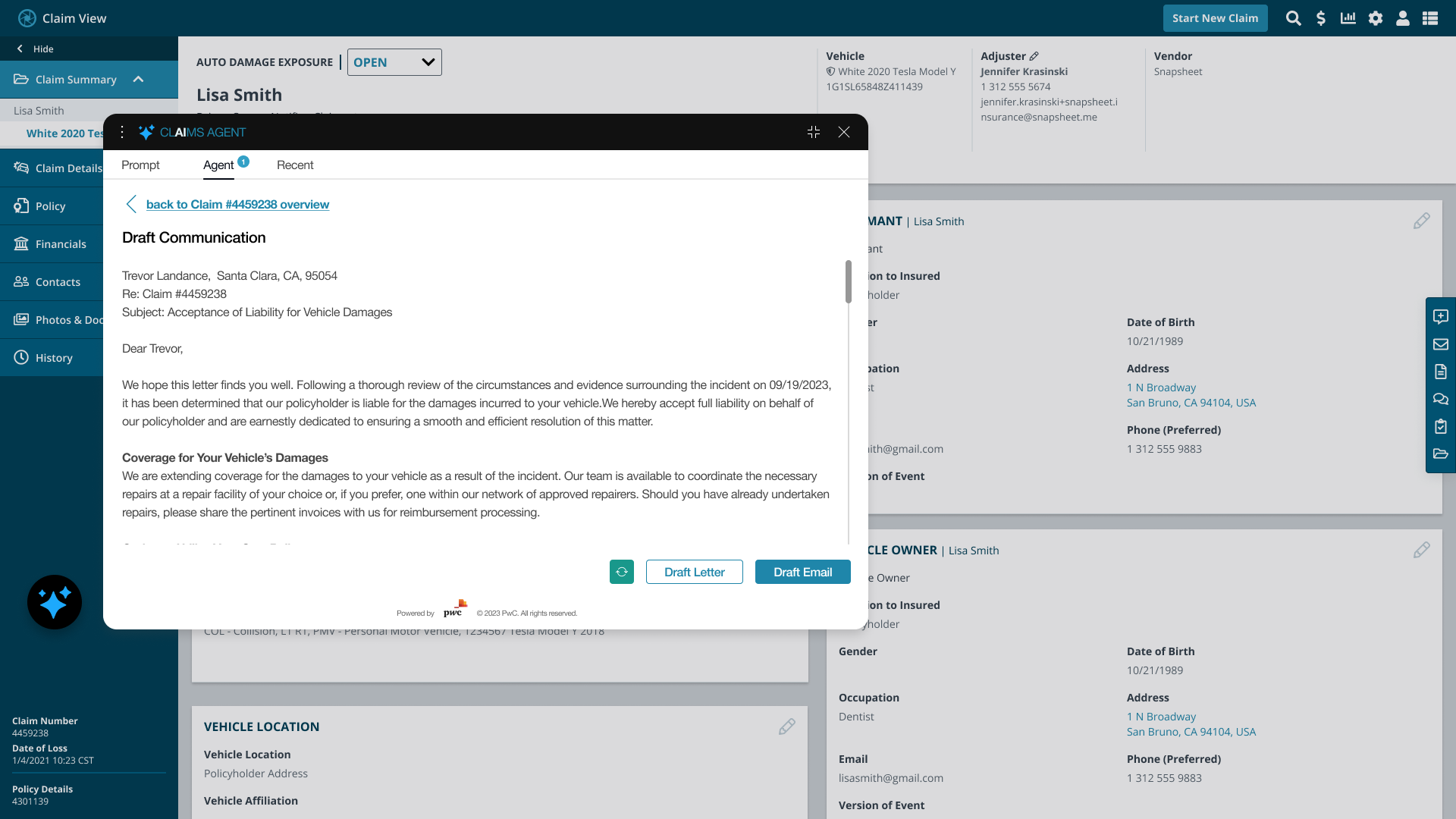

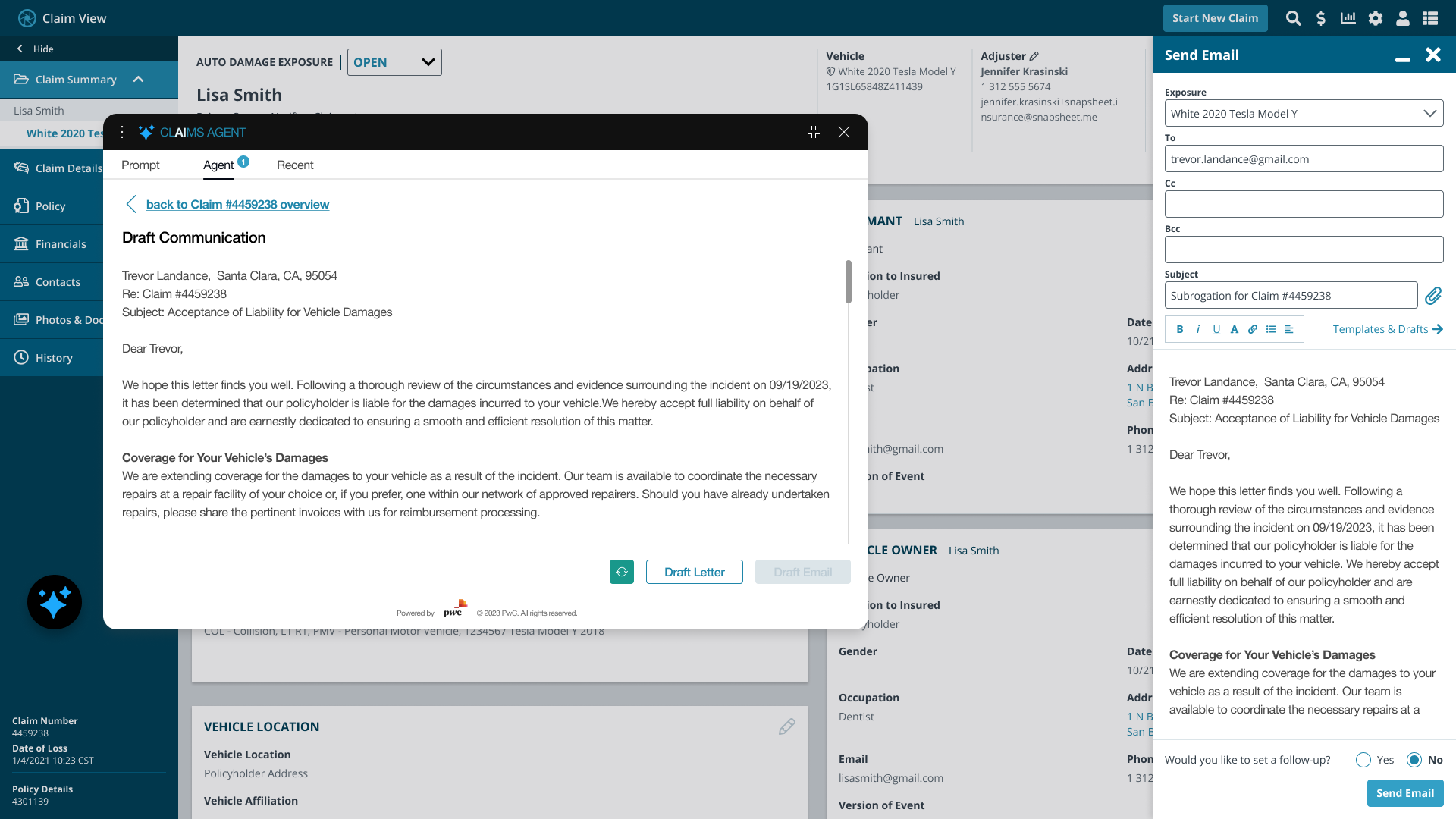

Automated Communications & Insights: Simplifies communication by automatically sending settlement emails and providing adjusters with insights into liability and outcomes.

-

Efficient Payment & Services Coordination: Enhances efficiency by streamlining payments, accurately estimating repair costs, sourcing affordable parts, and arranging rental cars, all aimed at improving the claimant experience.

-

Machine Learning for Improved Accuracy: Uses machine learning to continually refine its processes, boosting the system’s accuracy and decision-making with ongoing adjuster input and claim data.

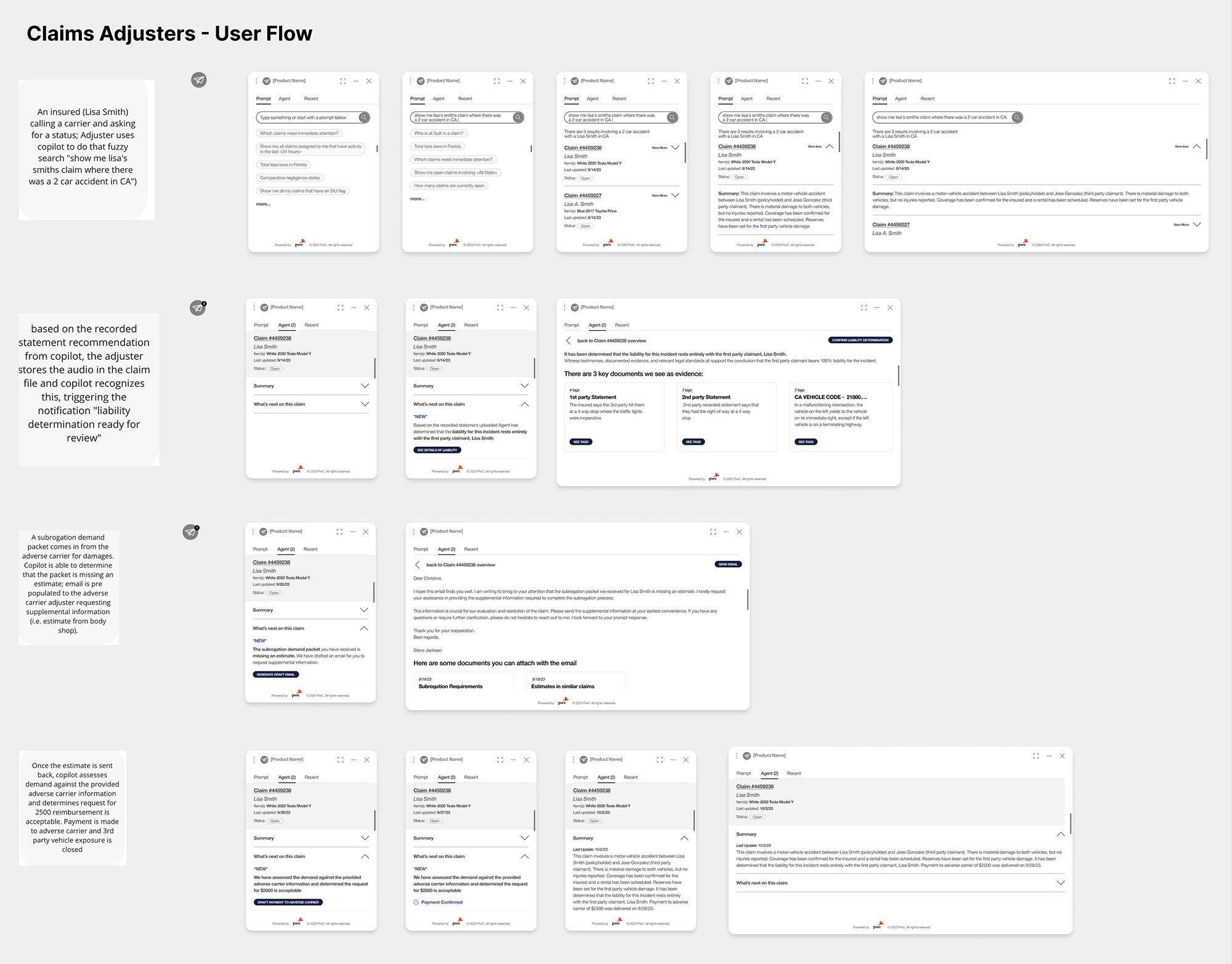

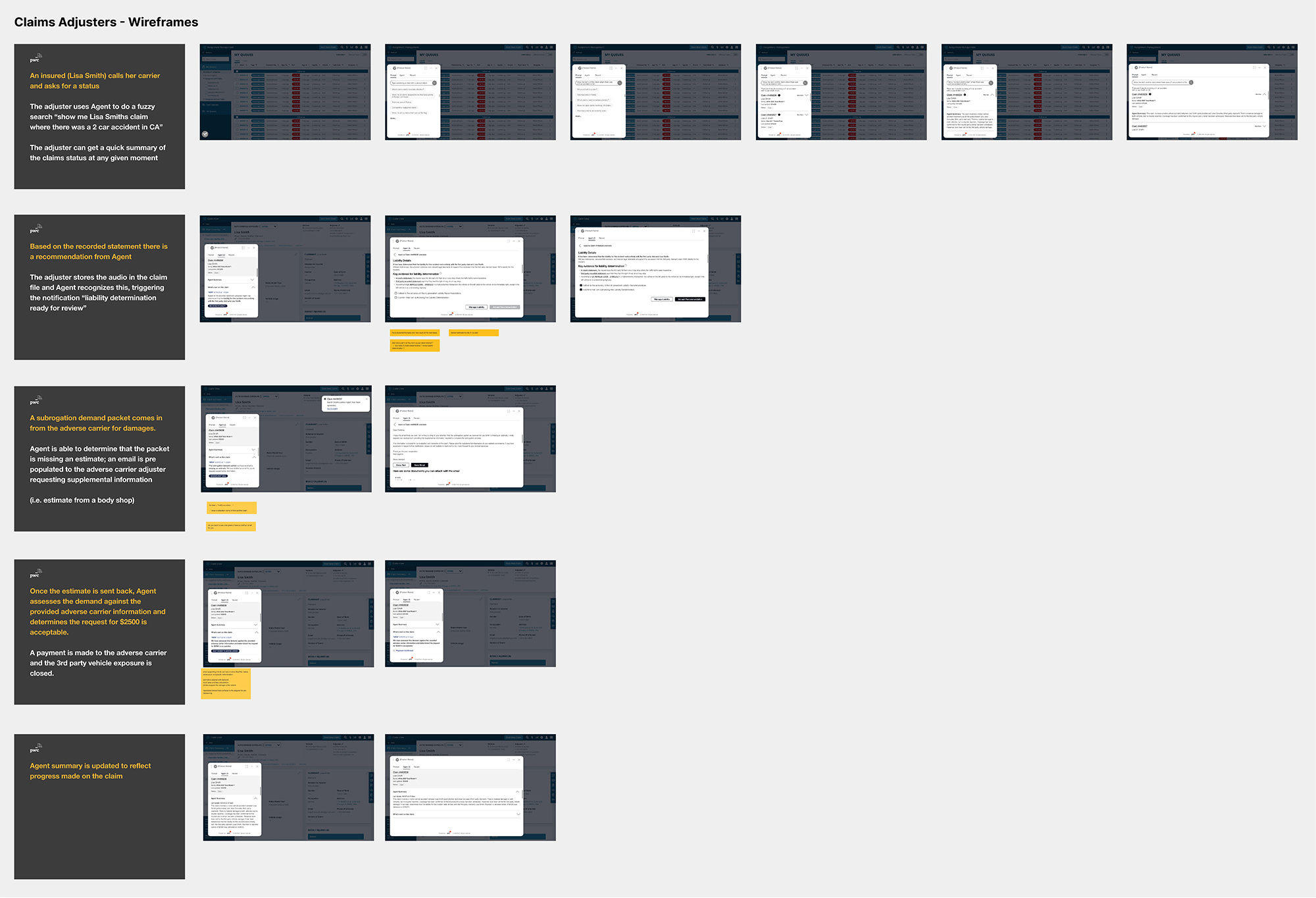

User Flow

I created initial sketches and developed detailed wireframes to visually outline and refine the user interface

Wireframes

STAGE 2: CONCEPTUALIZE – Key Findings Overview

In the Conceptualize stage, we defined the system’s design by developing detailed user personas, which emphasized the need for an efficient and user-friendly claims management system. We incorporated AI-enabled features to provide precise liability recommendations, ensure legal compliance, automate communications, streamline payment processing, and improve accuracy through machine learning. Detailed user flows were created to ensure a seamless user experience, while sketches and wireframes focused on clarity and usability. These steps laid the foundation for a robust system tailored to the specific needs and challenges of insurance adjusters.

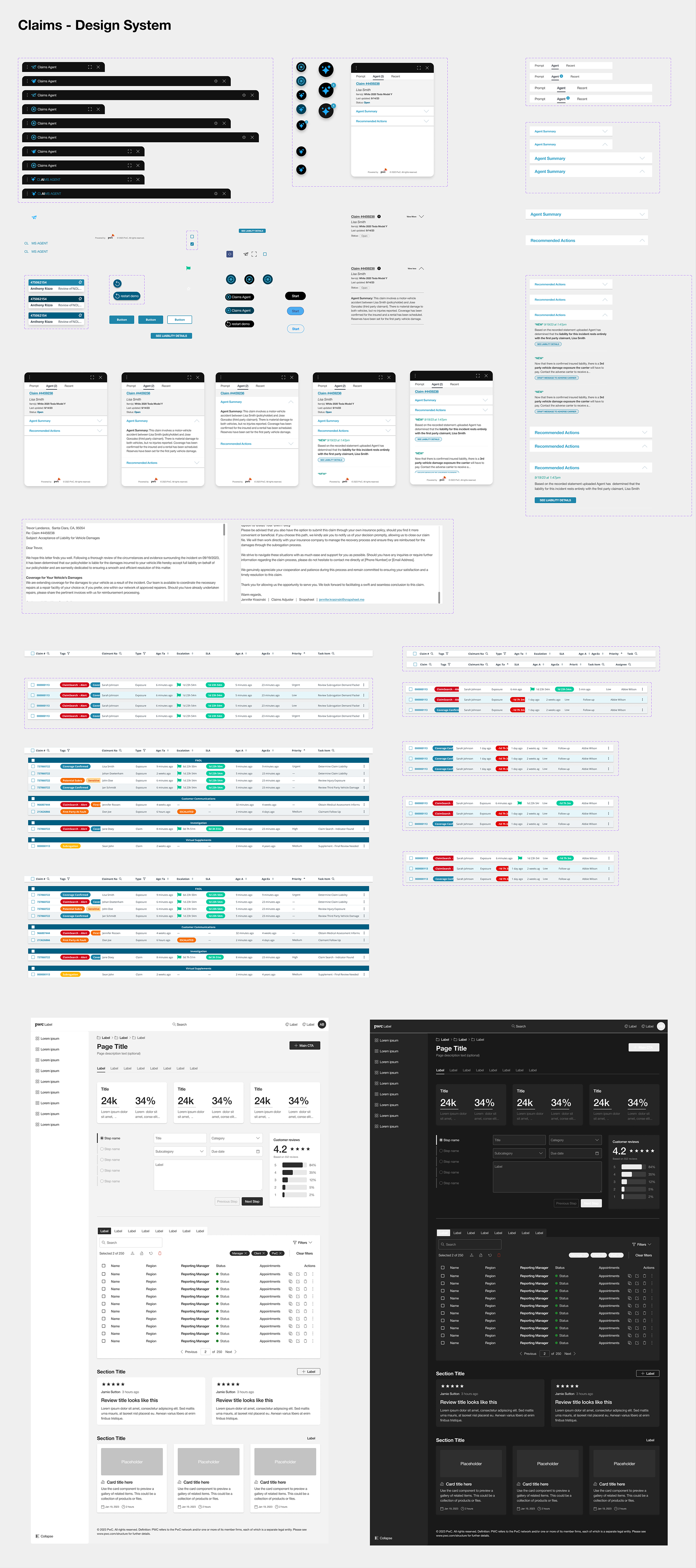

STAGE 3: DESIGN

Tasks

- Develop Prototype

- Set Up User Testing Frameworks

- Craft High-Fidelity Designs

- Establish a Comprehensive Design System

Prototype & User Testing

Developed prototypes and conducted comprehensive user testing with six current insurance adjusters to gather insights about their expectations and requirements.

Key Findings

-

Positive Feedback on AI-Driven Insights: Adjusters appreciated the accuracy and usefulness of the AI-generated liability recommendations and cost estimations, which significantly aided their decision-making process.

-

Streamlined Workflow: Users found the system’s streamlined workflow and intuitive interface made it easier to manage and process claims efficiently, reducing the overall time spent on each claim.

-

Improved Communication Tools: The automated communication features were well-received, as they simplified the process of sending clear and consistent emails to claimants, enhancing communication and transparency.

-

Need for Enhanced Training Resources: Some adjusters indicated that they required more comprehensive training materials to fully utilize the system’s advanced AI features, highlighting a need for better onboarding support.

-

Adjustments for Data Presentation: Feedback suggested that the presentation of some data could be clearer, prompting design adjustments to improve the readability and accessibility of key information on the interface

PROJECT OUTCOMES

- Enhanced Claims Efficiency: The new system streamlined the claims process, resulting in a 31% reduction in the time required to process each claim.

- Improved Accuracy: AI-driven tools increased the accuracy of liability assessments and cost estimations by 23%, reducing errors significantly.

- Better Communication: Automated communication features ensured clear, consistent, and timely interactions with claimants, improving customer satisfaction.

- Operational Improvements: The system’s integration led to smoother operations and a more effective claims management process.

- User-Friendly Interface: The intuitive design and streamlined workflows made the system 37% easier to navigate, reducing cognitive load and increasing productivity.

- Positive User Adoption: 79% of adjusters reported high satisfaction with the new system, indicating its effectiveness in meeting their needs.

- Training and Onboarding: Adjusters experienced a smoother onboarding process with comprehensive training resources, facilitating quicker adaptation to the new system.

- Increased Productivity: The efficiency improvements allowed adjusters to handle more claims per week, enhancing their overall productivity.

KNOWLEDGE GAINED

-

Leveraging AI for Operational Efficiency: AI can significantly improve decision-making accuracy and streamline repetitive tasks, but its integration needs to be thoughtful and user-friendly to be effective.

-

Feedback Loops are Key to Improvement: Regular feedback from actual system users is invaluable for iterative design improvements, ensuring the solution remains relevant and effective over time.

-

Balancing Automation with Human Insight: While AI and automation offer tremendous benefits, the human element remains irreplaceable for nuanced decisions and empathy in customer interactions.

-

Change Management is Critical: Implementing new systems requires careful planning and support to ensure user adoption and to mitigate resistance to change.

-

Continuous Learning and Adaptation: The project highlighted the importance of building systems that can evolve, learning from user interactions and external changes to stay effective.

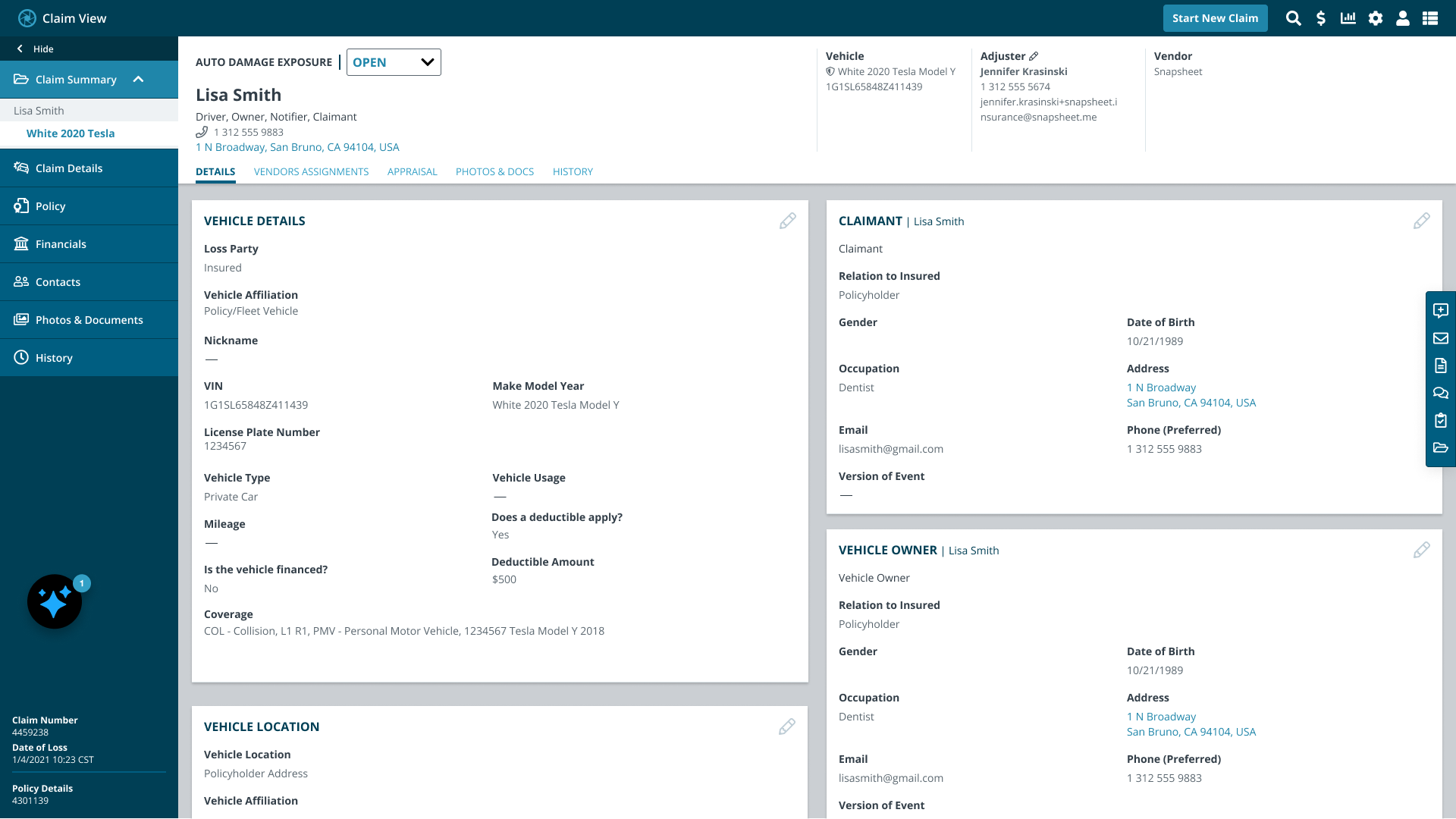

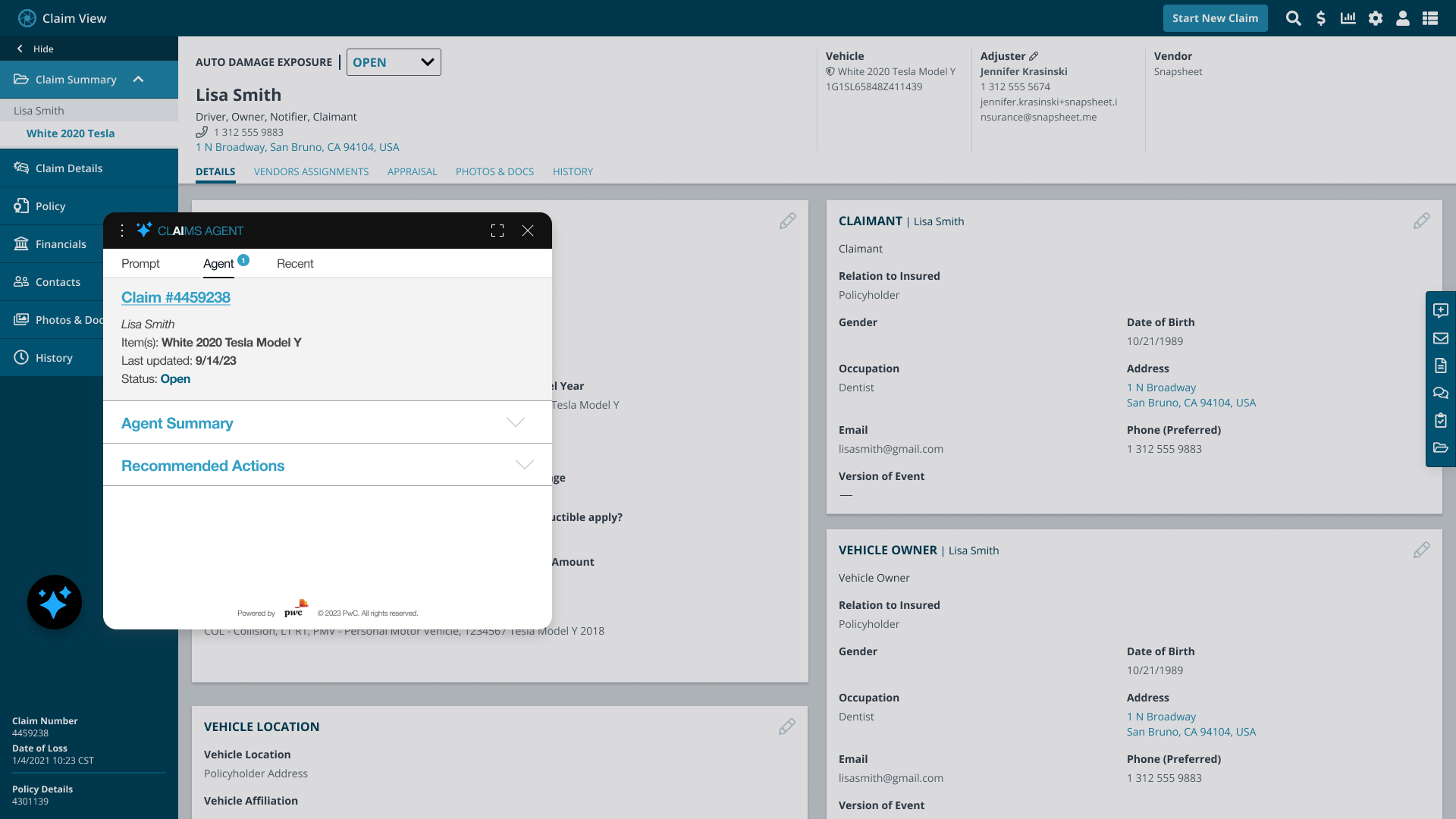

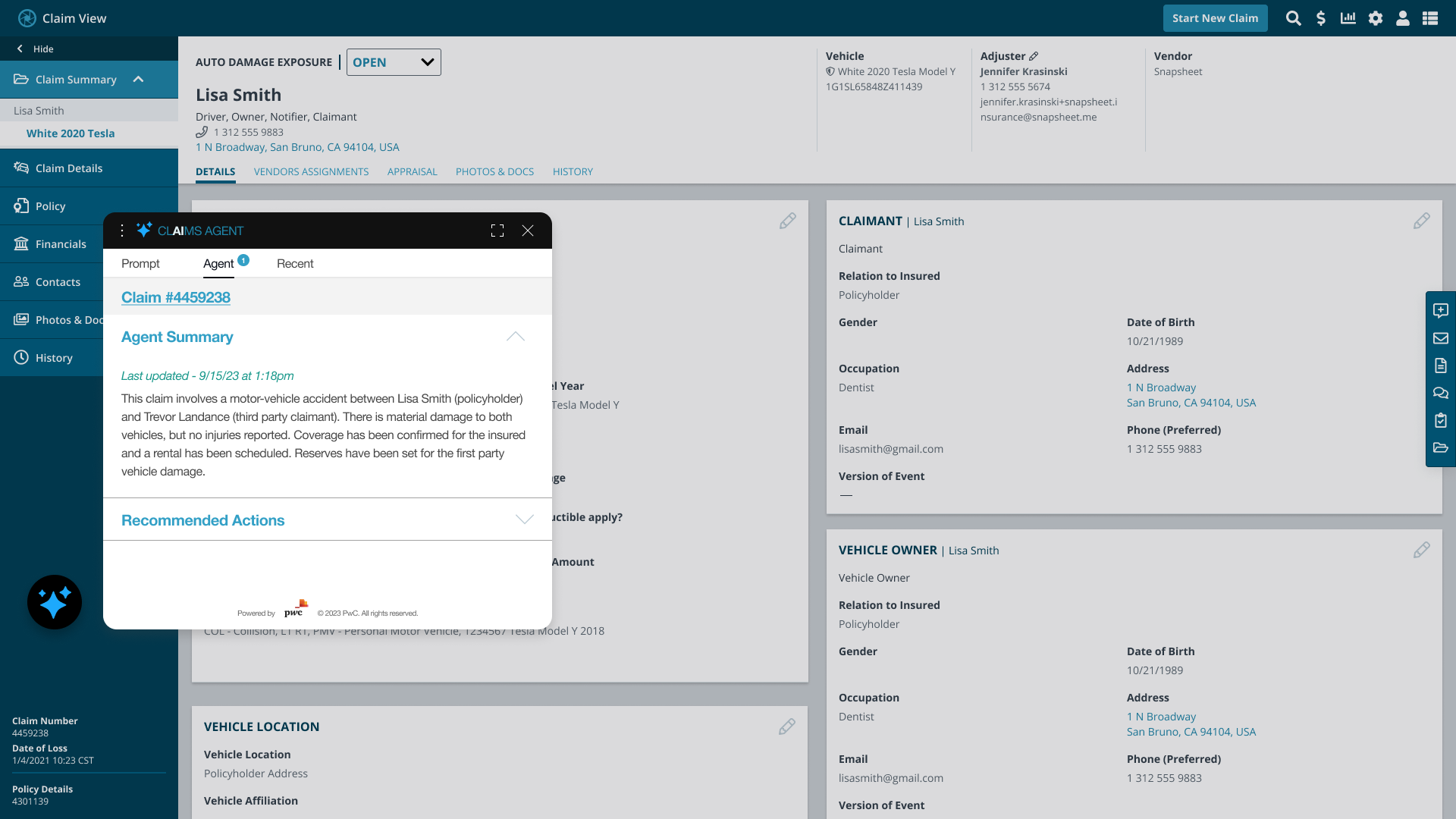

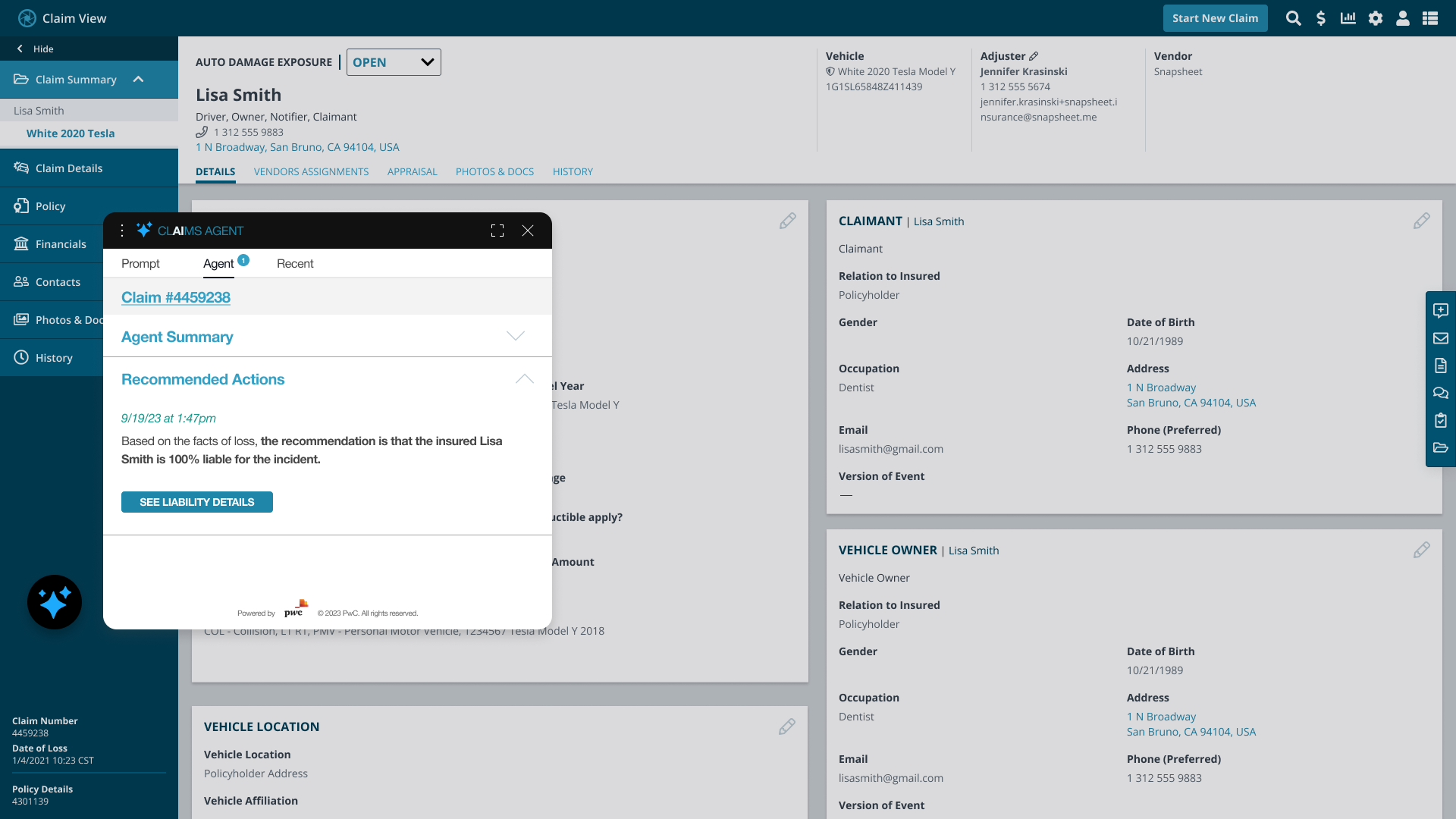

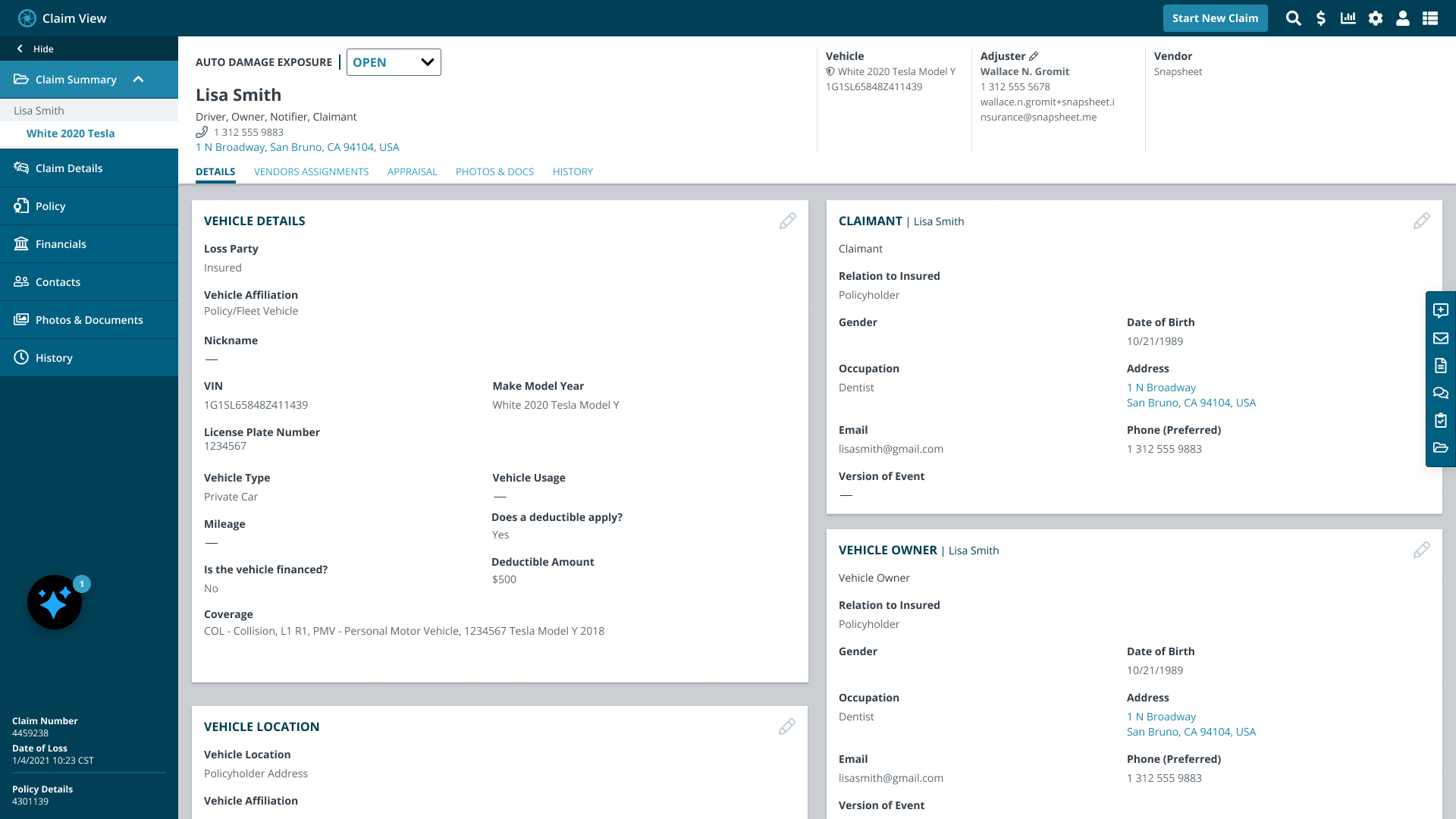

Final Designs

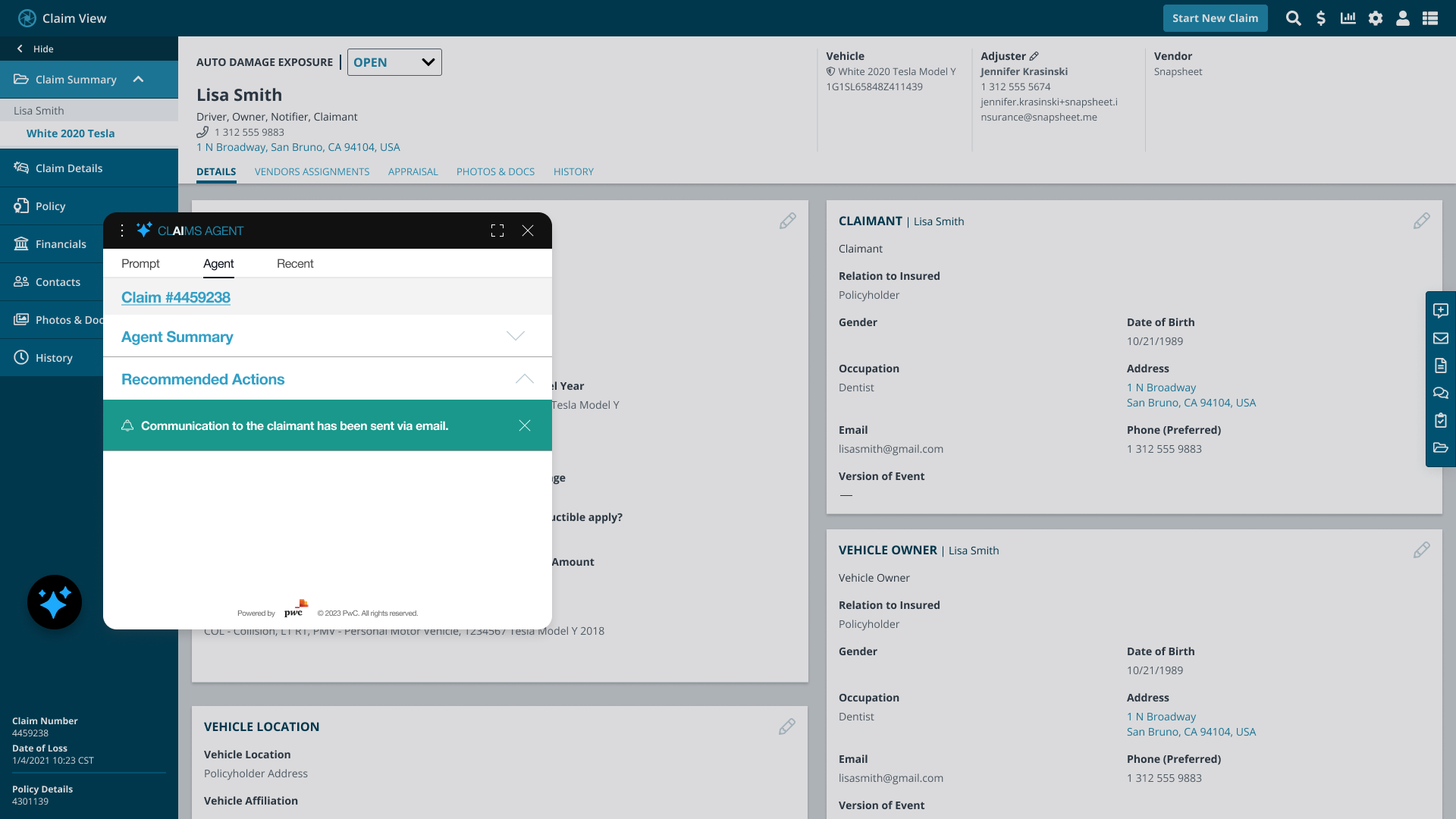

AI Agent – Claim Notification

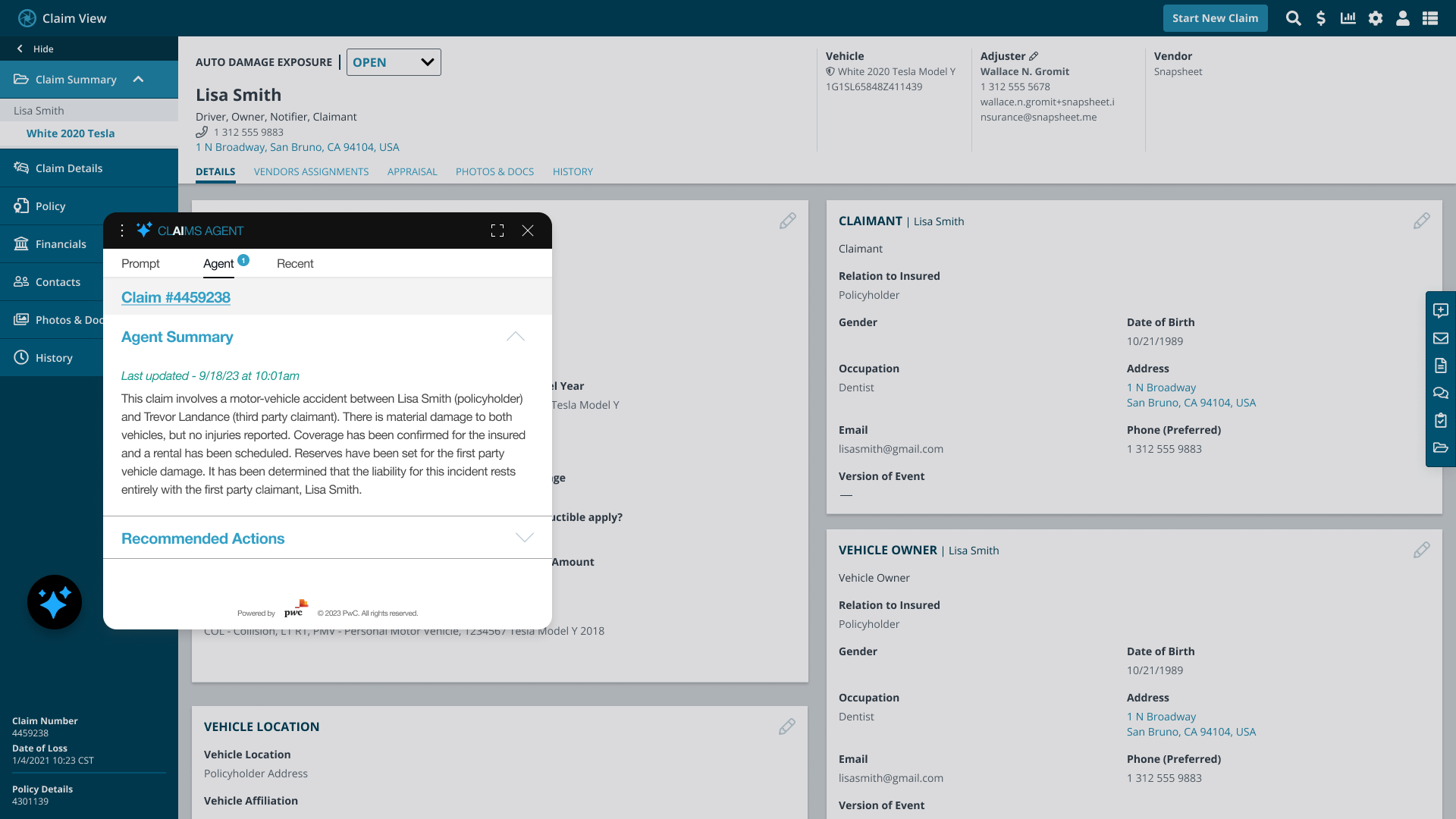

AI Agent – Claim Overview Modal

AI Agent – Claim Summary

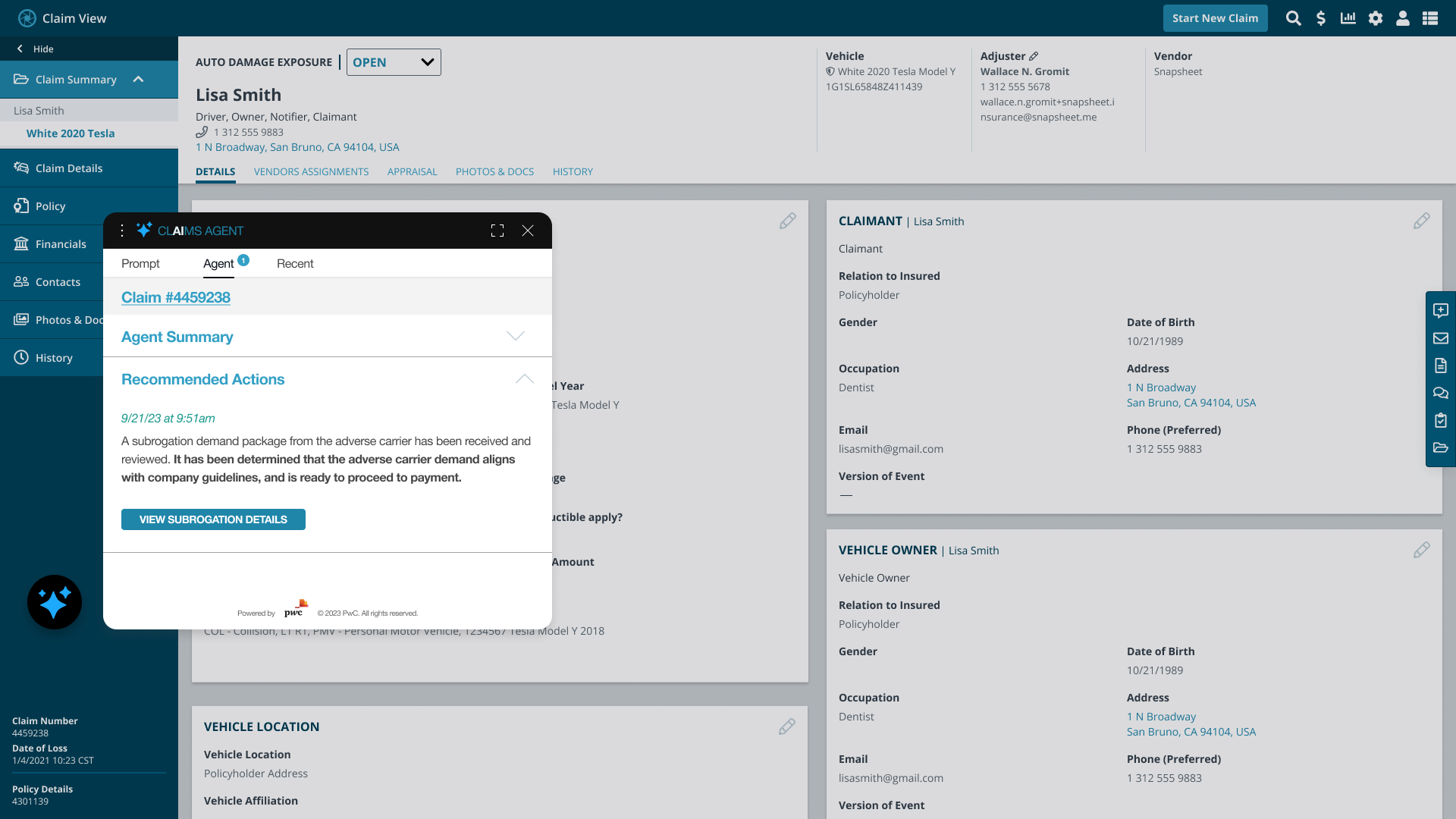

AI Agent – Claim Recommended Actions

AI Agent – Claim Recommended Liability Details

AI Agent – Claim Recommended Actions – Draft Email

AI Agent – Claim Recommended Actions – Draft Email Message

AI Agent – Claim Recommended Actions – Send Email Message

AI Agent – Claim Email Message Sent Confirmation

AI Agent – Claim Notification

AI Agent – Claim Summary

AI Agent – Claim Recommended Actions

AI Agent – Subrogation Details

AI Agent – Claim Payment Issued Confirmation

Design System